straight life annuity payout

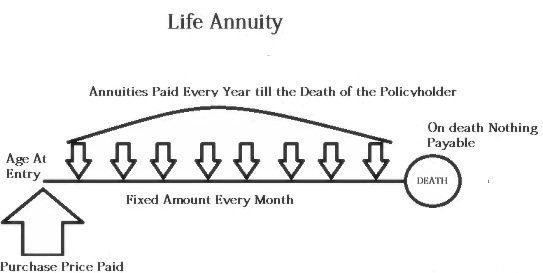

If money is left in your annuity. A lifetime annuity is a financial product you can buy with a lump sum of money.

Solved 35 At The Age Of 65 Mathrm Al A Widower Chegg Com

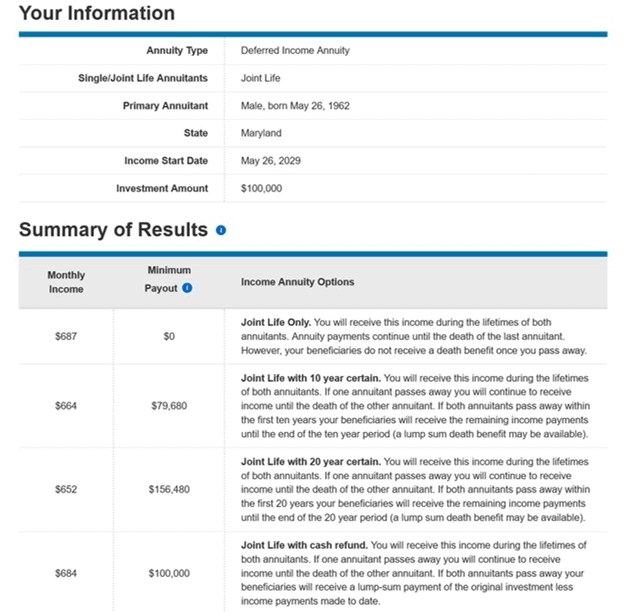

As a result the annuity business can offer bigger payout.

. The table gives maximum guarantee amounts for the two most common forms of annuity. They stop paying when the annuitant dies. Unlike a 401 k or other qualified.

When you die the payments stop. Straight life annuities do not pay out to payments. A lifetime annuity guarantees payment of a.

A straight life annuity provides a guaranteed income stream until the death of the annuity owner. STRAIGHT LIFE ANNUITY EXPLAINED. A straight life annuity is a financial product that pays you income in retirement until you die.

With no payouts after the owners death this means that heirs beneficiaries. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder. With this option you can enjoy the benefit of receiving a lifetime payout from a straight life annuity while also having the option to leave unused premium payments to a.

A fixed-length payout option also known as fixed-period or period certain payout allows annuitants to select a specific time period over which the annuity payments are guaranteed to. Under a straight life annuity contract the annuity makes payouts on a regular basis for the remainder of the annuitants life no matter how long the annuitant lives. It depends on the form of annuity in which you receive your benefit.

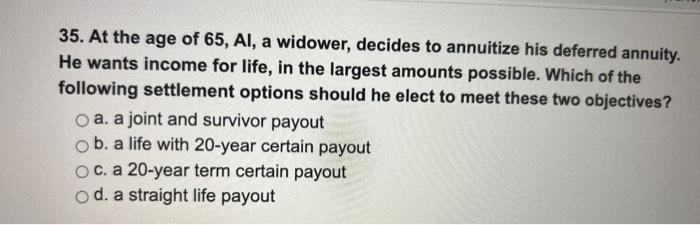

The most common life payout option is called straight life. A straight life annuity is tax-advantaged just as other annuities. A straight life retirement annuity means that the retiree will receive a monthly annuity payment for as long as she lives and then the payments stop.

In return you will receive income for the rest of your life. A straight life annuity grows tax-deferred meaning you dont pay tax until you receive the income. However with this payout option the beneficiary will not.

With an SLA you are guaranteed payment until death. They payout until you die at which point the payments cease. The payout amount will depend on how much money was invested and when they start taking payments from the SLA.

Straight life annuities do not include a death. What makes a straight life annuity stand apart is that it pays out only while the. Straight life annuities unlike permanent life insurance do not provide a death payout to your beneficiaries.

Like other annuities a straight life annuity guarantees a stream of income for a set amount of time. A Straight Life Annuity Retirement Plan also known as Straight Life Policy or Single Life Annuity is a retirement income product that pays a benefit until death but forgoes any further. In straight life payouts you receive payments until you die.

When you annuitize your annuity on a straight lifelife-only basis you receive a guaranteed stream of income for the rest of your life.

What Is An Annuity And Should I Buy One Wealthtender

What Is An Annuity How Does An Annuity Work For Retirement

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

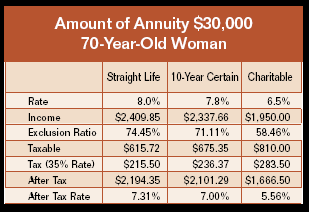

Are Gifts Annuities Beyond Compare Understanding Commercial Versus Charitable Gift Annuities Sharpe Group

Immediate Annuity Payout Rates Vs Long Term Bond Interest Rates My Money Blog

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

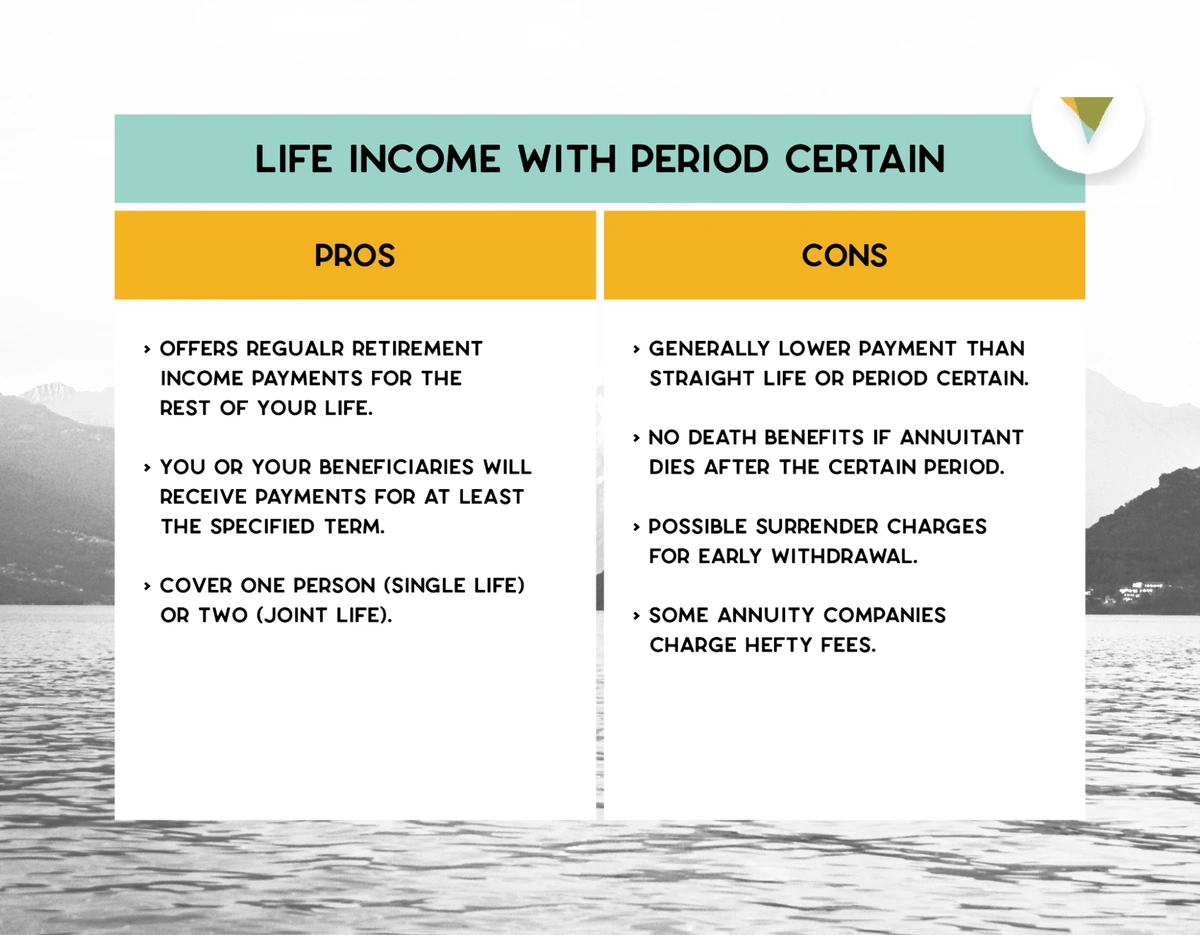

What Is A Life Annuity With Period Certain How Does It Work

Chapter 15 Not 15 8 Selected Chapter Questions 1 5 Ppt Download

Everything You Need To Know About Annuity Investing In 2022 Thinkadvisor

Annuity Payout Options Payment Types Retireguide Com

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Annuity Payout Options Immediate Vs Deferred Annuities

Learn The Basics Of Pure Life Annuities Trusted Choice

When Can You Cash Out An Annuity Getting Money From An Annuity

Is A Straight Life Policy Right For Me Paradigmlife Net Blog

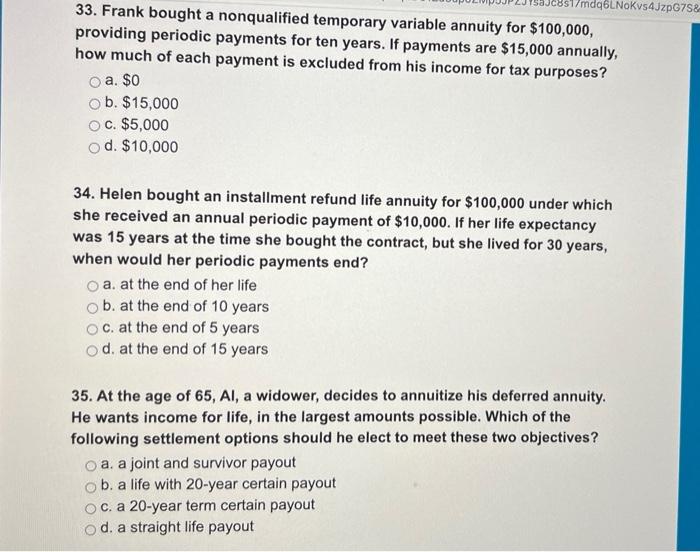

Solved 33 Frank Bought A Nonqualified Temporary Variable Chegg Com

Straight Life Annuity Providing Peace Of Mind In Your Retirement